•

1 min read

Why Savings Accounts Still Dominate- Even When Better Alternatives Exist

Introduction: The power of familiarity

Despite the availability of more efficient alternatives, most people continue to store the majority of their money in savings accounts.

This behaviour persists not because savings accounts are optimal, but because they are familiar.

Understanding this behaviour requires examining both financial systems and human psychology.

The origins of savings accounts

Savings accounts were originally designed to:

Store money safely

Provide liquidity

Enable transactions

They were never intended to maximise growth.

Their primary role was safety and accessibility.

Behavioural inertia: why people don’t switch

Humans tend to continue using systems that feel familiar.

This is known as behavioural inertia.

Even when better options exist, people avoid changing their habits because:

The current system feels safe

The effort to change feels unnecessary

The perceived benefit seems small

This keeps savings accounts dominant.

The illusion of safety

Savings accounts feel safe because:

They do not fluctuate visibly

They are familiar

However, safety and efficiency are different concepts.

Money that earns low returns may lose efficiency over time relative to inflation.

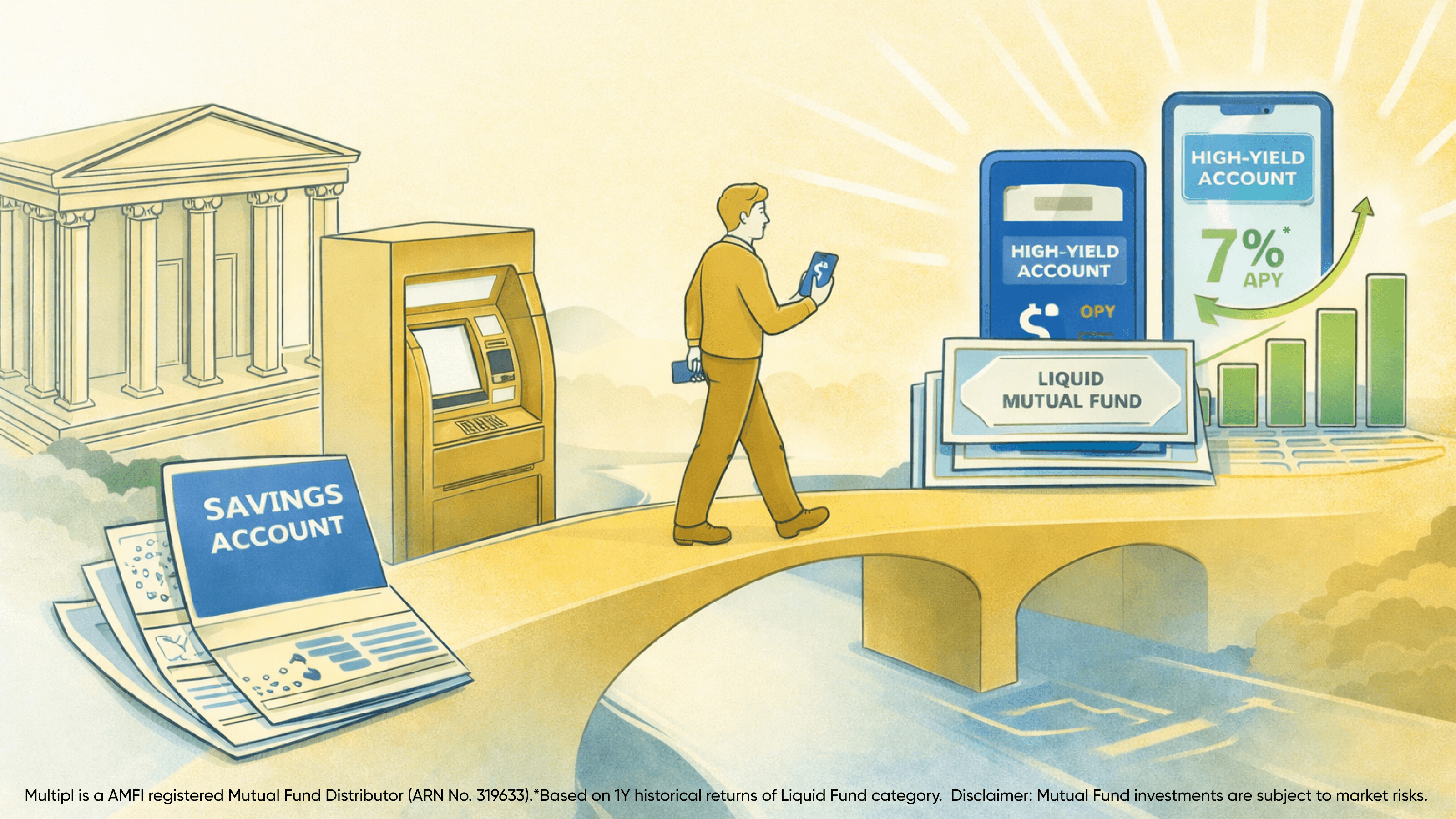

Institutional cash management vs individual behaviour

Interestingly, corporations rarely store large amounts of idle cash in savings accounts.

Instead, they use liquid mutual funds and similar tools.

This highlights a difference between institutional and individual cash management behaviour.

Higher-Yield Spending Accounts bring institutional-level cash management principles to individuals.

The role of infrastructure evolution

Financial infrastructure evolves gradually.

New systems often coexist with older ones before becoming widely adopted.

Savings accounts remain important.

But newer tools like liquid mutual funds and Higher-Yield Spending Accounts provide additional efficiency.

Conclusion

Savings accounts remain dominant due to familiarity and behavioural inertia.

However, modern financial tools provide more efficient alternatives for managing idle money.

Understanding these options allows individuals to make more informed decisions.