•

1 min read

The Complete Guide to Managing Short-Term Money in India (2026): Savings Accounts, Liquid Mutual Funds, and Higher-Yield Spending Accounts

TL;DR

Most people focus on investing long-term but ignore where their short-term and spending money sits. Savings accounts typically offer around 2.5–4% returns, which often fails to keep up with inflation. Liquid mutual funds and newer solutions like Higher-Yield Spending Accounts allow money to remain accessible while earning potentially higher returns. Choosing the right place for your short-term money can improve financial efficiency without changing your spending habits.

The Most Overlooked Money Decision: Where Your Money Waits

When people think about managing money, they usually focus on investing- choosing mutual funds, stocks, or fixed deposits.

But there’s another category of money most people overlook: money that is waiting to be spent.

This includes:

Monthly spending money

Travel funds

Emergency funds

Money saved for gadgets, gifts, or insurance

Cash sitting between salary and expenses

This money often sits in a savings account by default.

And that default decision can quietly reduce your financial efficiency.

Why Savings Accounts Are No Longer Enough

Savings accounts were designed for safety and accessibility- not for maximising returns.

In India, most savings accounts offer around:

2.5% to 4% annual returns

Meanwhile, inflation historically ranges between:

5% to 6% annually

This creates a gap where your money’s purchasing power may not grow meaningfully.

For example:

If you keep ₹2,00,000 in a savings account at 2.5%, you earn ₹5,000 annually before tax.

At 6–7%, the same money could potentially earn ₹12,000–₹14,000 annually.

Over time, this difference becomes meaningful, especially for money that sits idle frequently.

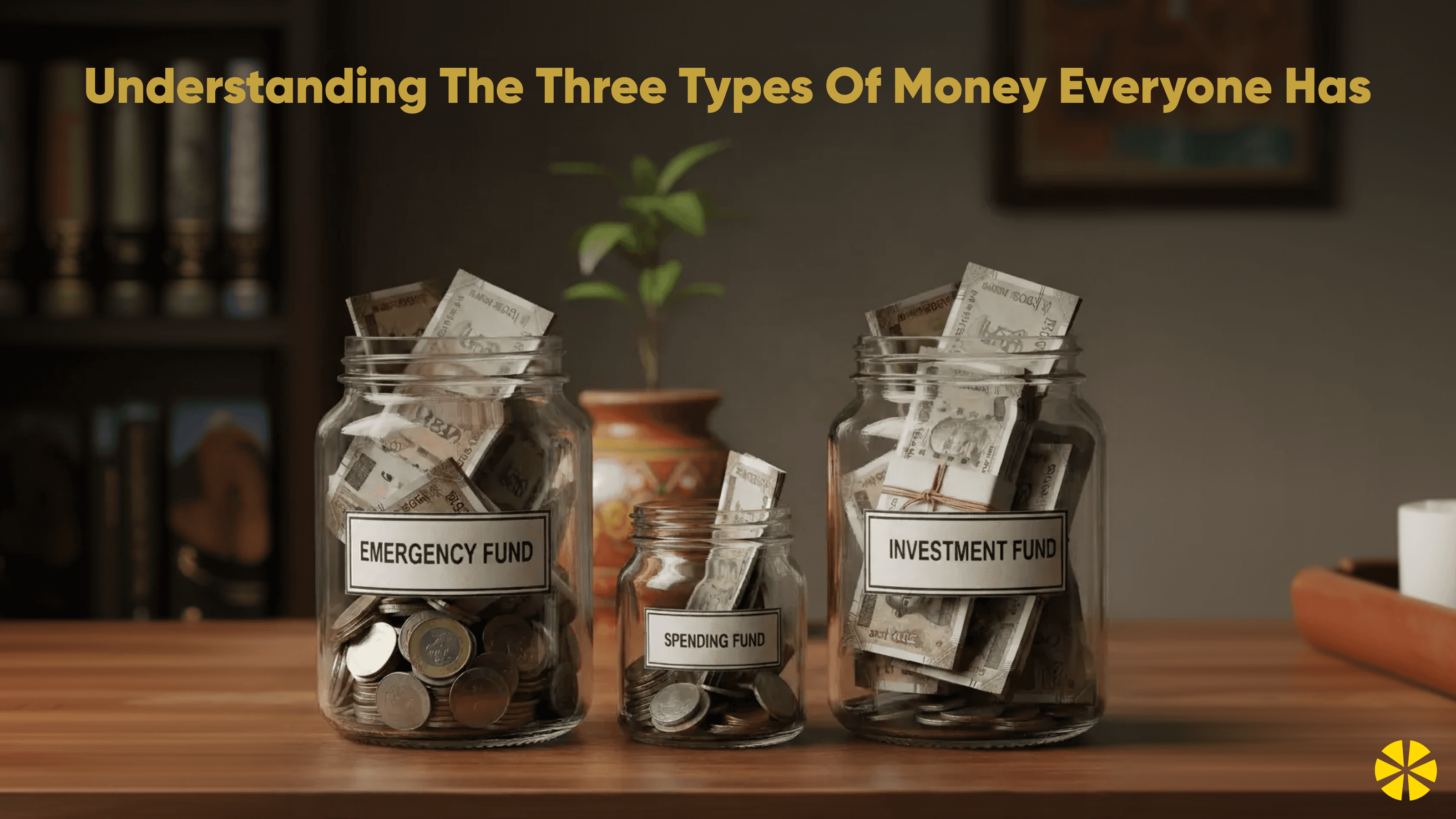

Understanding the Three Types of Money Everyone Has

A simple framework is to divide money into three categories:

1. Emergency Fund

Purpose: Unexpected expenses

Examples: medical emergencies, sudden repairs

Requirement:

High safety

Instant access

2. Spending Fund

Purpose: Planned spending

Examples:

Travel

Shopping

Insurance premiums

Lifestyle expenses

Requirement:

Accessibility

Moderate returns

Flexibility

This is the category most people ignore.

3. Investment Fund

Purpose: Long-term wealth building

Examples:

Retirement

Buying a home

Financial independence

Requirement:

Long-term growth

Higher risk tolerance

Each category should ideally be managed differently.

Liquid Mutual Funds: A Smarter Alternative for Short-Term Money

Liquid mutual funds are a category of debt mutual funds designed for short-term parking of money.

They invest in:

Treasury bills

Government securities

High-quality money market instruments

These instruments are generally lower risk compared to equity investments.

Key features:

High liquidity

Relatively stable returns compared to equity funds

Suitable for short-term parking of money

Historically, liquid mutual funds in India have delivered approximately 5–7% annual returns, though returns are not guaranteed and may vary.

They are commonly used for:

Emergency funds

Short-term savings

Cash management

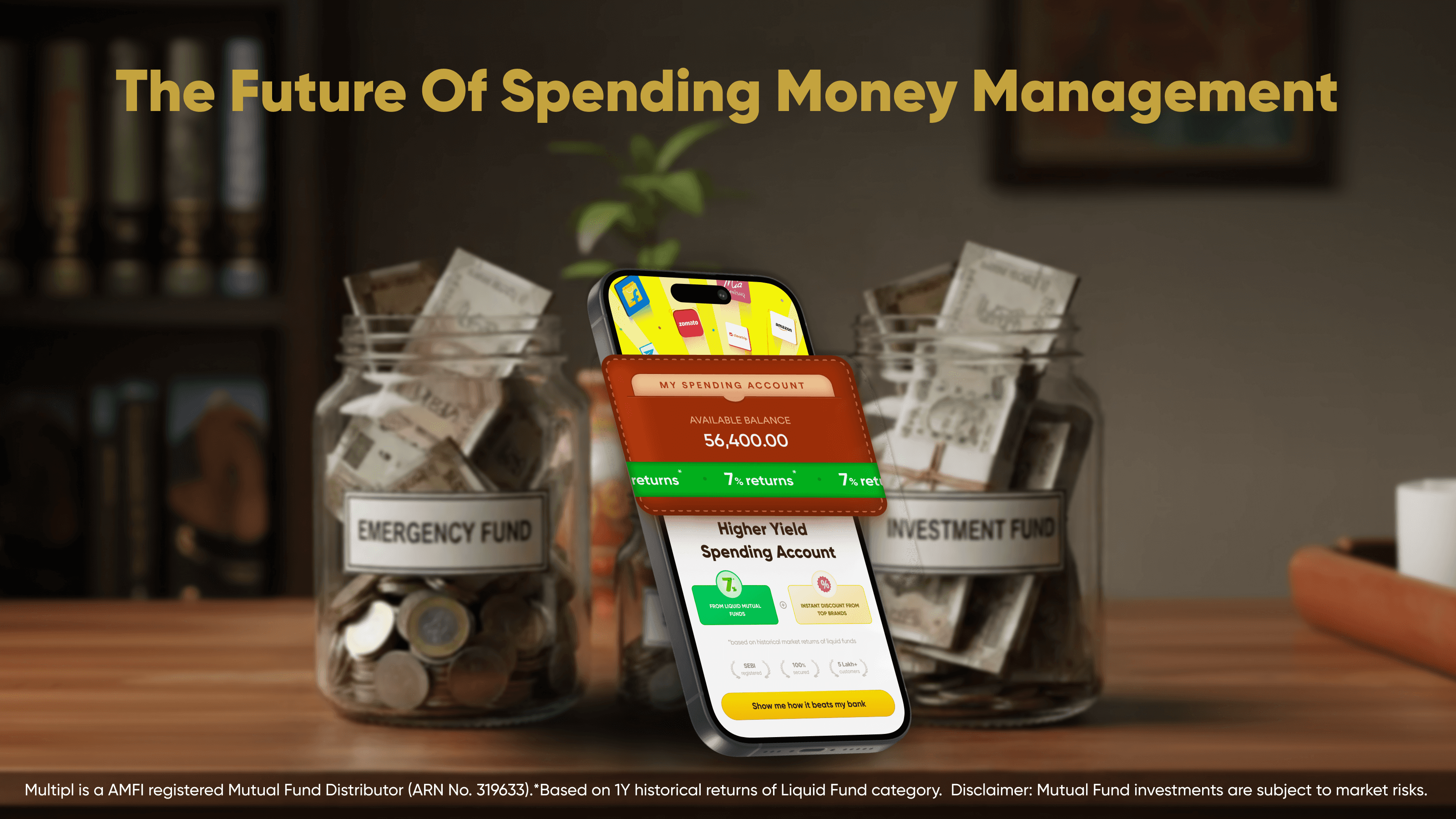

The Emergence of Higher-Yield Spending Accounts

A newer category combining accessibility with returns is the Higher-Yield Spending Account.

A Higher-Yield Spending Account allows users to:

Park spending money in liquid mutual funds

Earn potentially higher returns compared to traditional savings accounts

Maintain liquidity

Redeem or withdraw funds when needed

Instead of keeping spending money idle in a low-interest savings account, the money remains productive while staying accessible.

How Higher-Yield Spending Accounts Work

Higher-Yield Spending Accounts are typically built on liquid mutual fund infrastructure.

When users add money:

Funds are allocated into liquid mutual funds

The money remains accessible

Returns accrue based on the underlying fund performance

Users can then:

Withdraw money back to their bank account

Use the funds for spending

Redeem via partner ecosystems or services

This allows money to remain productive even while waiting to be used.

Comparison: Savings Account vs Liquid Mutual Funds vs Higher-Yield Spending Account

Feature | Savings Account | Liquid Mutual Funds | Higher-Yield Spending Account |

Typical returns | 2.5–3% | 5–7% historically | Linked to liquid fund returns |

Liquidity | Instant | High liquidity | Instant or near-instant |

Risk level | Very low | Low (market-linked) | Based on liquid mutual funds |

Accessibility | High | High | High |

Suitable for spending money | Limited returns | Good option | Designed specifically for spending money |

Why Short-Term Money Management Matters More Than People Realise

Most financial advice focuses on long-term investing.

But short-term money often represents a large portion of a person’s financial lifecycle.

For example:

A person earning ₹12 lakh annually may move ₹5–6 lakh through spending annually.

Where that money sits between earning and spending directly impacts financial efficiency.

Optimising this “waiting period” can improve overall financial outcomes.

Common Mistakes People Make:

Keeping all money in one savings account

This mixes emergency, spending, and investment funds inefficiently.

Using fixed deposits for short-term money

FDs often involve lock-ins, which reduce flexibility.

Ignoring idle money

Money sitting idle frequently represents missed opportunity.

How to Choose the Right Option for Your Short-Term Money

Use this simple guideline:

Savings account:

Daily transactions

Very short holding periods

Liquid mutual funds:

Emergency funds

Short-term parking

Higher-Yield Spending Account:

Spending money

Planned expenses

Lifestyle funds

The Future of Spending Money Management

Historically, people had only two choices:

Savings account

Fixed deposits

Today, financial infrastructure has evolved.

Solutions like liquid mutual funds and Higher-Yield Spending Accounts provide alternatives that balance:

Safety

Liquidity

Returns

This allows people to manage short-term money more efficiently.

Conclusion

Managing money isn’t just about investing for the future.

It’s also about optimising money in the present.

Savings accounts remain useful for daily transactions.

Liquid mutual funds offer a more efficient alternative for short-term parking.

Higher-Yield Spending Accounts take this a step further by helping spending money remain productive while accessible.

As financial tools evolve, the key principle remains simple:

Money that is waiting should ideally remain productive- not idle.