•

1 min read

Savings Account vs Liquid Mutual Funds vs Higher-Yield Spending Accounts: The Complete 2026 Comparison Guide

Introduction: Why this comparison matters more today than ever

For decades, the savings account has been the default place to store money. It is familiar, convenient, and universally available.

But financial infrastructure has evolved significantly.

Today, individuals have access to tools that allow their money to remain both accessible and productive. Among these, liquid mutual funds and Higher-Yield Spending Accounts represent important developments.

Understanding how these options compare helps individuals make better decisions about where to store their short-term and spending money.

Understanding the purpose of each option

Before comparing returns, it is important to understand the original purpose behind each option.

Savings accounts: designed for transactions

Savings accounts were built primarily to enable:

Deposits and withdrawals

Everyday transactions

Immediate liquidity

Returns were never their primary function.

Their main goal is convenience.

Liquid mutual funds: designed for cash management

Liquid mutual funds were created to manage short-term idle money efficiently.

They invest in:

Treasury bills

Government securities

Money market instruments

These instruments are selected for their short maturity periods and relative stability.

Liquid mutual funds are widely used by:

Corporations

Businesses

Institutional investors

to manage idle cash.

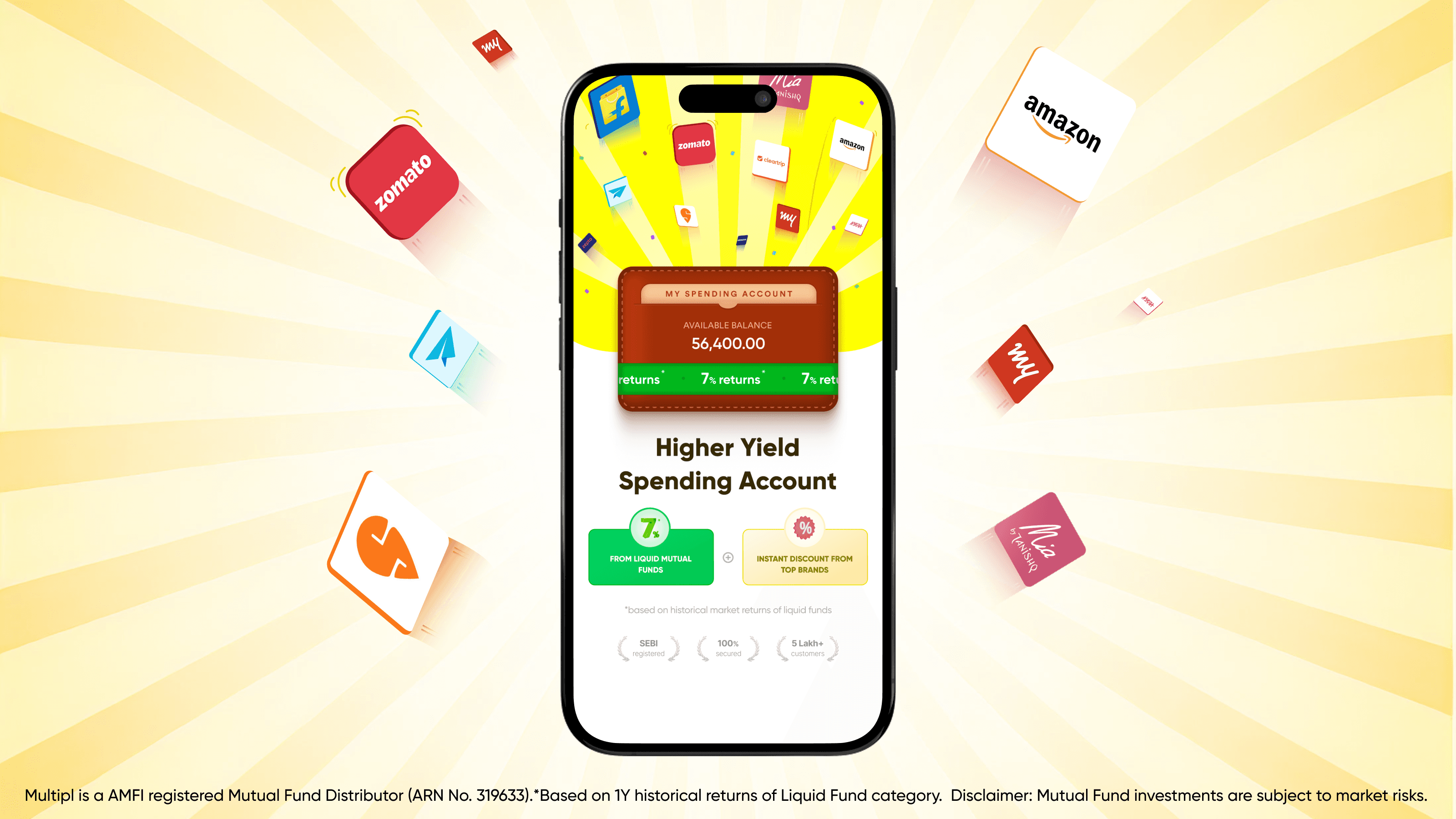

Higher-Yield Spending Accounts: designed for spending money efficiency

Higher-Yield Spending Accounts represent an evolution of personal finance infrastructure.

They allow individuals to:

Store spending money in liquid mutual funds

Maintain accessibility

Improve cash efficiency

This bridges the gap between traditional savings accounts and investment tools.

Comparing returns

Savings accounts typically offer:

2.5% to 4% annually

Liquid mutual funds have historically delivered approximately:

5% to 7% annually (not guaranteed)

Higher-Yield Spending Accounts derive their returns from liquid mutual funds.

This allows spending money to potentially remain more efficient while accessible.

Comparing liquidity

Liquidity refers to how quickly money can be accessed.

Savings accounts offer instant liquidity.

Liquid mutual funds offer high liquidity, though redemption may take some processing time depending on platform and fund structure.

Higher-Yield Spending Accounts are designed to integrate liquidity with spending infrastructure.

Comparing risk levels

Savings accounts are considered very low risk.

Liquid mutual funds carry low risk relative to equity mutual funds, as they invest in short-term debt instruments.

Higher-Yield Spending Accounts inherit the risk characteristics of liquid mutual funds.

Accessibility and usability

Savings accounts are familiar and simple to use.

Liquid mutual funds require selecting funds and managing redemptions.

Higher-Yield Spending Accounts simplify this by integrating liquid mutual funds into spending workflows.

This makes efficient cash management easier.

Which option is best for different purposes?

Savings accounts are best suited for:

Daily transactions

Immediate liquidity needs

Liquid mutual funds are best suited for:

Emergency funds

Short-term savings

Higher-Yield Spending Accounts are best suited for:

Spending money

Planned lifestyle expenses

Improving cash efficiency

Conclusion

Savings accounts remain useful for transactions.

Liquid mutual funds provide better efficiency for short-term money.

Higher-Yield Spending Accounts extend this concept by helping spending money remain productive while accessible.

Understanding these differences helps individuals make better financial decisions.