•

1 min read

The Spending Money Hack: How to Use HYSA (Higher-Yield Spending account) to Earn While You Shop

Most people focus on earning more on savings.

Very few think about earning on spending money.

That’s strange, because a large part of your money isn’t saved forever, it’s waiting to be spent on groceries, travel, gadgets, bills, or upcoming purchases. And while it waits, it usually earns just 2.5% in a bank savings account.

This guide explains a simple but powerful idea:

How to use Multipl Higher-Yield Spending Account (HYSA) to earn 6–7% on money you’re going to spend anyway, without locking it up or changing how you shop.

TL;DR

If you don’t want to read the whole thing:

Spending money usually sits idle for weeks or months

Bank savings earn ~2.5% on this idle money

Liquid mutual funds historically earn ~6–7%

A HYSA lets you use liquid funds for spending, not just saving

You earn while you wait, withdraw instantly, and spend as usual with additional brand discounts when you spend

That’s the spending money hack.

What Is a HYSA (Higher-Yield Spending Account)?

A Higher-Yield Spending Account is designed for money that will be spent soon, not years later.

Unlike a regular savings account:

Money is invested in liquid mutual funds

It earns higher returns than bank savings

It stays fully liquid

You can withdraw and spend anytime with additional brand discounts ~8-10%

Think of it as a better place for your spending money to wait.

The Problem With How Most People Handle Spending Money

Let’s take a normal monthly flow:

Salary comes in

Money sits in a savings account

Over the next few weeks, you spend on the following with additional brand discounts

Food delivery

Quick commerce

Shopping

Travel bookings

Bills and EMIs

The issue isn’t spending.

The issue is that this money waits idle before it’s spent, earning almost nothing.

Even though it’s not “savings”, it’s still money sitting around.

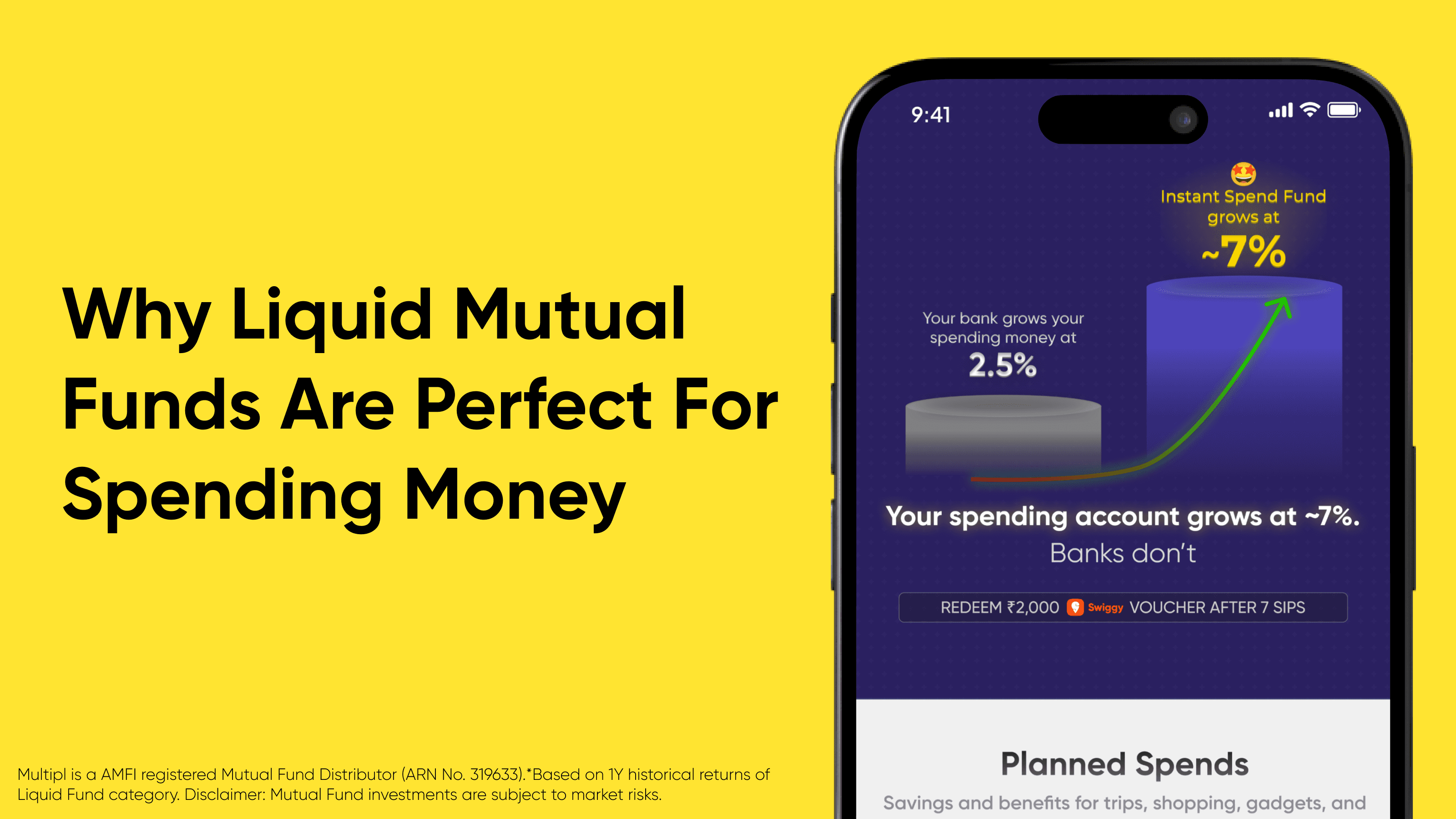

Why Liquid Mutual Funds Are Perfect for Spending Money

Liquid mutual funds are built for short-term parking, not long-term investing.

Key features

Invest in very short-term, high-quality debt instruments

Low volatility compared to equity funds

Easy redemption (often same day or next day)

Historically deliver 6–7% returns, better than savings accounts

This makes them ideal for:

Emergency funds

Short-term cash

Spending money that hasn’t been spent yet

The HYSA Spending Strategy (Step-by-Step)

Here’s how people actually use this in real life.

Step 1: Identify “waiting money”

This includes:

Monthly shopping budget

Travel money for upcoming trips

Gadget or phone upgrade fund

Insurance or EMI buffers

If you’re going to spend it in the next few weeks or months, it qualifies.

Step 2: Park it in Multipl HYSA instead of a bank

Instead of letting this money sit at 2.5%, you park it in a HYSA backed by liquid mutual funds, earning ~6–7%.

You’re not “investing for the long term”.

You’re simply letting money work while it waits.

Step 3: Withdraw instantly when you need to spend

When it’s time to pay:

Redeem instantly or near-instantly

Spend as usual, UPI, cards, vouchers, with additional brand discounts when you spend

No lock-ins, no penalties

From your point of view, nothing changes, except returns.

Real-Life Spending Scenarios

1. Shopping & Food

Money allocated for groceries or platforms like Swiggy sits for weeks.

In a HYSA, it earns until the day you order.

2. Travel Planning

Flight and hotel bookings are usually planned 1–3 months ahead.

That’s a long waiting window for money to earn more than 2.5%.

3. EMI & Bill Buffers

Many people keep 1–2 months of EMIs or bills ready in advance.

That buffer can earn returns without losing liquidity.

HYSA vs Keeping Spending Money in a Bank

Feature | Bank Savings | HYSA |

|---|---|---|

Returns | ~2.5% | ~6–7% (historical) |

Liquidity | High | High |

Lock-in | None | None |

Purpose | Generic | Spending-specific |

Efficiency | Low | High |

Brand Discounts | None | ~8-10% |

The difference isn’t dramatic in one month.

It compounds quietly over time.

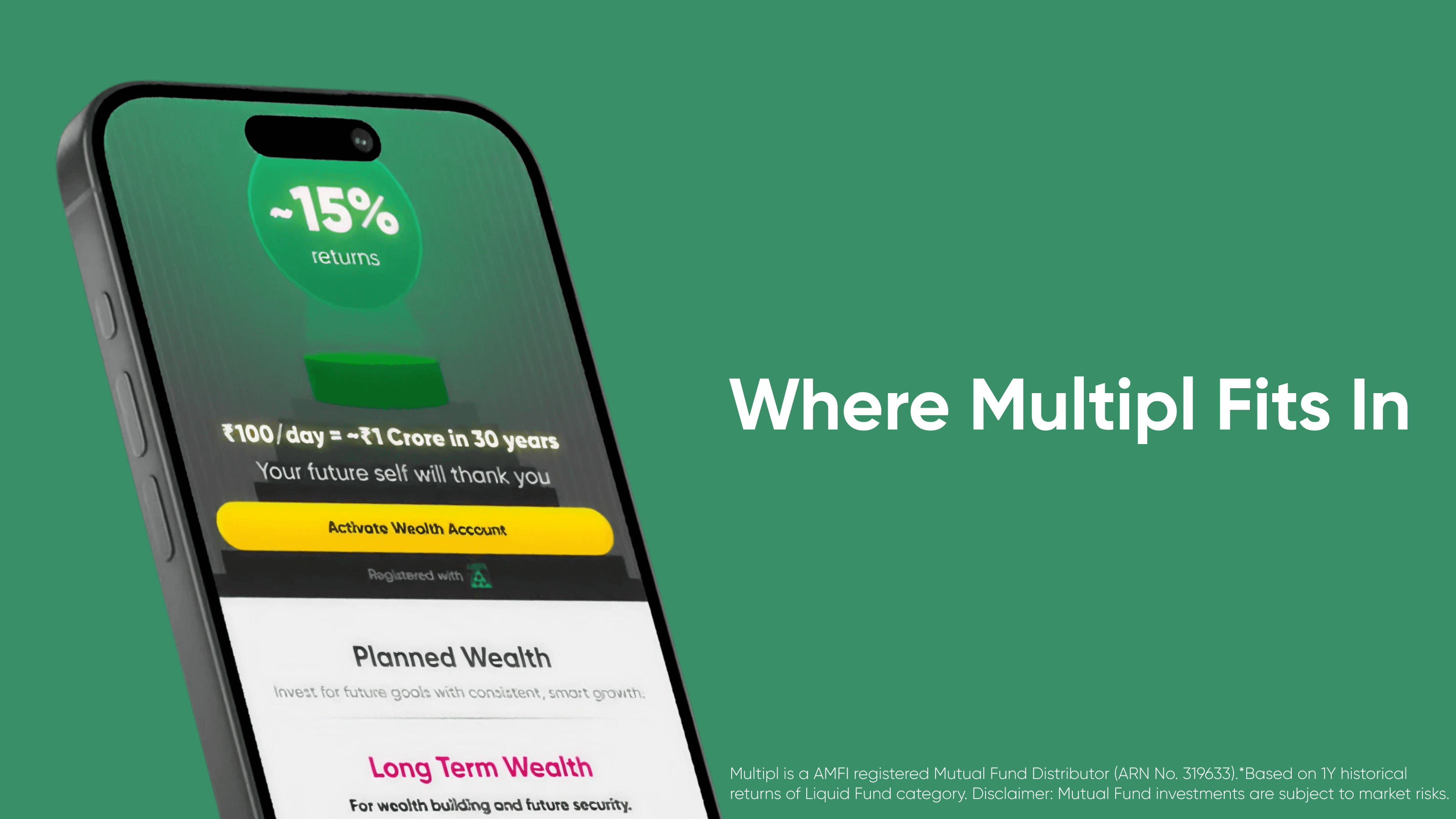

Where Multipl Fits In

Multipl applies this strategy specifically to spending money.

Instead of treating liquid funds as another investment product, Multipl positions them as a Higher-Yield Spending Account.

What makes it different

Money is invested in SEBI-regulated liquid mutual funds

Instant access for everyday spends

Earn up to 7% while money waits

Brand discounts when you actually spend

Designed around real spending behaviour, not portfolios

It’s not about “saving harder”.

It’s about using a smarter default for money you’re going to spend anyway.

Is This Safe?

Important clarity:

Liquid mutual funds are not bank deposits

They carry low risk, but not zero risk

They are regulated by SEBI and invest in high-quality instruments

For money meant to be spent soon, they are generally considered appropriate, not aggressive.

Common Questions

Is this better than a savings account?

For spending money, yes, historically.

For long-term safety or guarantees, savings accounts still matter.

Can I withdraw anytime?

Yes. Liquidity is the point of a HYSA.

Is this for long-term investing?

No. This is for parking and spending money, not retirement.

Final Take

The biggest missed opportunity in personal finance isn’t bad investing.

It’s idle spending money.

A HYSA simply fixes that gap, quietly, without lifestyle changes.

If money is going to wait anyway,

it might as well earn more while it does.

Stop letting spending money sit idle.

Upgrade how your money waits before you spend.