•

1 min read

Best Savings Account Alternatives in India 2026: Higher-Yield Options That Actually Work

Why your savings account is holding you back

If your bank pays you 3–4%, it feels safe.

It also quietly makes you poorer.

Here’s the thing most people miss:

Inflation in India often runs at ~5–6%.

Your savings account usually earns less than that.

That means your “safe” money is losing purchasing power every year.

So in 2026, the real question isn’t where to save.

It’s where to park money so it grows while staying accessible.

This guide compares the best savings account alternatives in India in 2026 - focusing on options that balance returns, liquidity, and simplicity.

What makes a good savings alternative in 2026?

Before jumping into products, your checklist should look like this:

Higher returns than 3–4%

Easy access (no long lock-ins)

Low complexity (no trading, no stress)

Reasonable risk

Works for everyday cash, not just “investments”

With that lens, let’s break down your best options.

Top Savings Account Alternatives in India (Ranked)

1) Liquid Mutual Funds - The smartest default

If there is one category that consistently beats bank savings, it’s liquid mutual funds.

Typical returns: 6–7%

Liquidity: Usually instant / same-day

Risk level: Low (but not zero)

Why they work

Liquid funds invest in very short-term debt instruments. That means:

Less volatility than equity

Much Higher returns than savings accounts

Quick access when you need money

For people parking emergency funds, travel money, or planned spends, this is arguably the best alternative today.

Downsides

Not risk-free like bank deposits

Returns vary slightly month-to-month

Who it’s for:

Anyone who wants better returns than a savings account but still needs fast access.

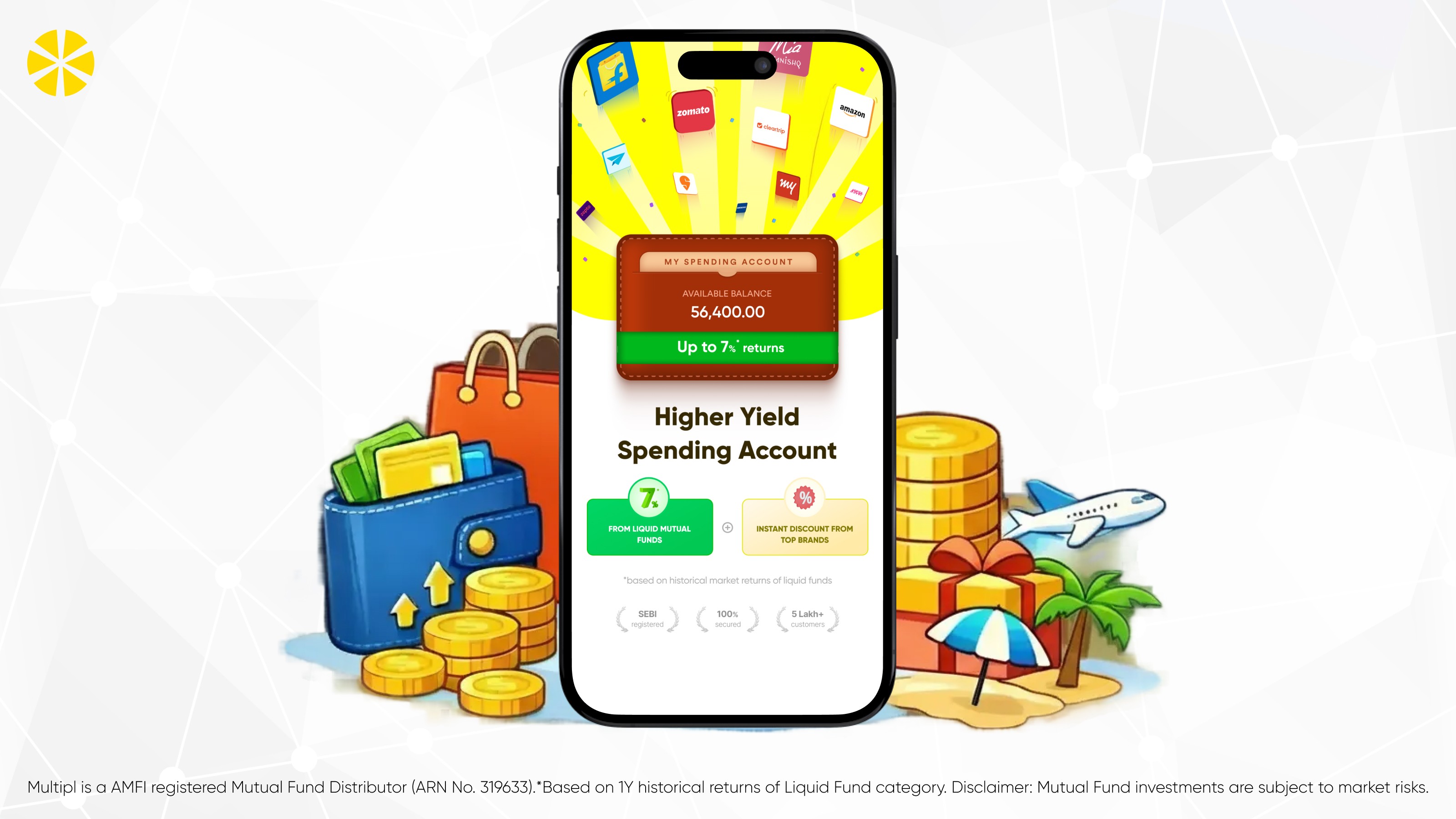

2) Higher-Yield Spending Accounts (like Multipl)

This is where things get interesting in 2026.

A Higher-Yield Spending Account (HYSA) is not a bank account.

It is a spending account powered by liquid mutual funds + brand discounts.

What you get:

Returns similar to liquid funds (historically ~6–7%)

Instant access

Zero lock-in

Discounts on everyday spending

Instead of keeping your “spending money” in a low-interest bank account, you let it sit in a liquid fund while you plan your spends.

Why this is better than a savings account

Most people don’t spend money the day they earn it.

There is always a waiting window - days or weeks.

A HYSA makes that waiting time productive.

You:

Park money

Earn returns

Redeem when you need to spend

Often get brand discounts on top

This is why platforms like Multipl are emerging as one of the best “savings account alternatives” in 2026.

Best for:

Everyday cash, shopping money, travel funds, short-term goals.

3) Fixed Deposits (FDs)

Returns: ~6–7% (varies by bank)

Liquidity: Low (penalties for early withdrawal)

FDs are great if:

You don’t need the money

You are okay locking it in

But they are terrible for spending money or emergency funds.

If you break an FD early, your effective return can drop sharply - sometimes worse than savings accounts.

Good for: Long-term parking

Bad for: Daily cash or planned spends

4) Sweep-in FDs (Savings + FD hybrid)

Some banks let your savings account balance automatically move into FDs above a threshold.

Pros:

Better returns than savings account

Still linked to your bank

Cons:

Not instant liquidity

Complicated rules

Still lower flexibility than liquid funds

This is better than a normal savings account - but still not ideal.

5) Arbitrage Funds

These are equity mutual funds designed to behave like debt funds with lower tax impact.

Returns: ~5–6%

Liquidity: Usually T+2 or T+3 days

Risk: Low, but not zero

Good for tax efficiency if you stay invested for a while.

Not great if you need instant access.

6) Digital Super Savings Apps

Some fintech apps offer “High interest savings” features by investing in low-risk funds in the background.

Pros:

User-friendly

Higher returns than banks

Cons:

Often less transparent

Not always instant

Sometimes limited control over funds

Great for beginners, but not the most sophisticated option.

Savings vs Mutual Funds in India - The real comparison

Feature | Savings Account | Liquid Mutual Fund | Higher-Yield Spending Account |

Returns | 3–4% | ~6–7% | ~6–7% + brand discounts |

Liquidity | Instant | Mostly instant | Instant |

Lock-in | None | None | None |

Risk | Very low | Low | Low |

Rewards | None | None | Yes |

Best for | Emergency only | Parking cash | Spending + parking |

Bottom line:

If your money is meant to be spent soon, liquid funds or HYSA beat savings accounts every time.

Which option should YOU choose?

Here’s a simple decision rule:

If it’s your emergency fund:

Use liquid mutual funds or a HYSA.If it’s your spending money:

Use a Higher-Yield Spending Account (like Multipl).If it’s long-term savings:

Use FDs or long-term investments instead.

TL;DR

Your bank savings account is convenient but outdated in 2026.

For short-term parking and spending money, liquid mutual funds or a Higher-Yield Spending Account offer Higher returns, better liquidity, and smarter use of your cash - without adding complexity.

👉 Stop settling for 3–4%. Let your spending money earn more - explore Multipl today.