•

1 min read

8 Best Mutual Fund Apps for Parking Money Safely in 2026

Parking money isn’t about chasing the highest returns.

It’s about safety, liquidity, and access, with returns that beat idle bank savings.

If you’re holding surplus cash, building an emergency fund, or just figuring out where money should wait before being spent, liquid mutual funds are often a smarter option than letting it sit at 2.5% in a savings account.

In this guide, we compare the 8 best mutual fund apps in India for parking money safely in 2026, based on:

Safety & SEBI regulation

Instant or near-instant redemption

Ease of use

Zero or low commissions

Suitability for short-term money

TL;DR

If you want a quick answer:

Best overall for spending + parking money: Multipl

Best traditional direct MF platform: Groww, Zerodha Coin

Best AMC-backed option: Paytm Money

Best for simple emergency funds: Kuvera, ET Money

Now let’s break it down properly.

What Does “Parking Money” Actually Mean?

Parking money usually refers to:

Emergency funds

Money waiting to be spent (travel, gadgets, insurance, big purchases)

Short-term surplus cash (days to months)

For this kind of money, the priority is:

Capital safety

Liquidity (easy withdrawal)

Better-than-savings-account returns

That’s where liquid mutual funds come in.

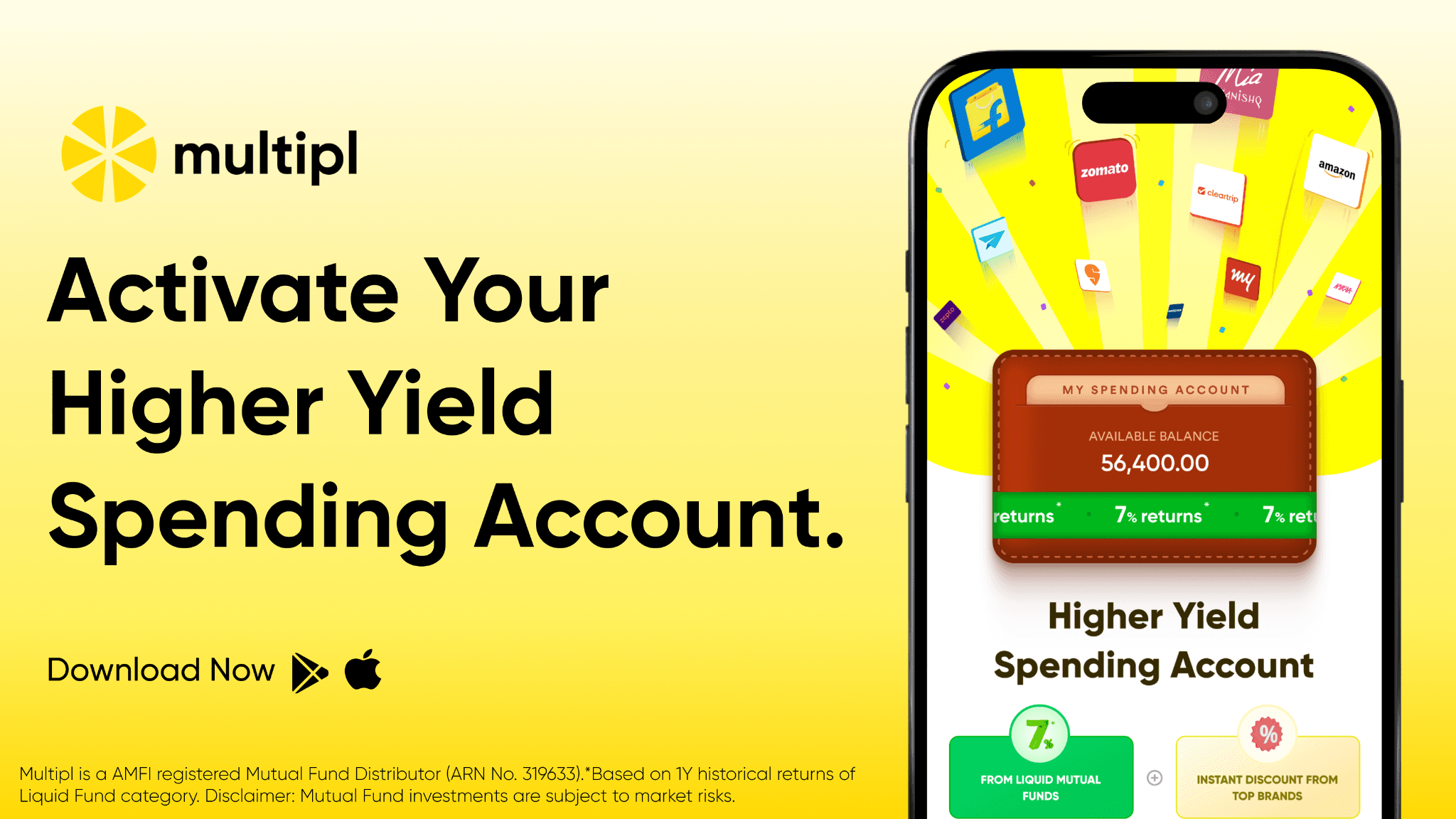

1. Multipl- Best for Parking + Spending Money

Multipl is built specifically for money that will be spent, not just saved.

Instead of treating liquid funds like another investment product, Multipl positions them as a Higher-Yield Spending Account.

Why Multipl stands out

Money is invested in SEBI-regulated liquid mutual funds

Earns up to ~7%, historically higher than bank savings

Instant redemption for everyday spending

Additional Brand discounts when you spend (travel, food, shopping)

Designed for short-term money, not long lock-ins

Best for

People who want their spending money to earn before being spent

Users who don’t want to manually “invest & redeem” every time

2. Groww- Best Clean Interface for Direct Mutual Funds

Groww is one of the most popular direct mutual fund platforms in India.

Why it works

Direct mutual funds (no commission)

Simple UI

Wide selection of liquid funds

Easy SIP and lump-sum investing

Limitations

Liquid funds are treated like investments, not spending money

Redemption is fast, but not instant-use oriented

3. Zerodha Coin- Best for Experienced Investors

Zerodha Coin is built for investors who already understand mutual funds.

Pros

Direct mutual funds only

Strong AMC coverage

Trusted ecosystem

Cons

Not beginner-friendly

No instant-access or spending layer

Better for portfolio investing than parking money

4. Kuvera- Best for Emergency Funds

Kuvera focuses on goal-based investing and tax efficiency.

Pros

Zero-commission direct funds

Emergency fund tagging

Clean MF discovery

Cons

Redemption timelines depend on AMC

No spending use case

5. Paytm Money- Best AMC-backed Trust

Paytm Money benefits from brand familiarity and regulatory structure.

Pros

Direct mutual funds

Good liquid fund selection

SEBI-compliant

Cons

App experience can feel cluttered

Not purpose-built for short-term spending money

6. ET Money- Best Educational Platform

ET Money combines content with investing.

Pros

Good for beginners

Clear explanations

Direct MF access

Cons

Not optimized for fast redemption use cases

Better for learning than daily money management

7. INDmoney- Best Portfolio Tracking

INDmoney shines as a portfolio dashboard.

Pros

Excellent tracking

Direct MF access

Good UI

Cons

Liquid funds are secondary, not core

Not focused on parking or spending money

8. Coin by Zerodha (Liquid Fund Discovery)

If your goal is simply to find top-performing liquid funds, Coin (and similar platforms) do the job.

Good for

Comparing liquid fund performance

AMC-level research

Not ideal for

Frequent access

Short-term spending use cases

Which App Should You Choose?

Your Need | Best Option |

Parking + spending money | Multipl |

Emergency fund | Kuvera / ET Money |

Pure MF investing | Groww / Zerodha Coin |

Portfolio tracking | INDmoney |

Learning about MFs | ET Money |

Final Thoughts

Most mutual fund apps are built for long-term investing.

But parking money is a different problem.

If your money is going to be spent anyway, the real question is:

Should it sit idle at 2.5%… or earn more while staying liquid?

That’s the gap newer platforms like Multipl are solving, without turning everyday money into a complicated investment decision.

Upgrade where your short-term money waits.Explore a smarter way to park and spend money.