Multipl Wealth Management Pvt. Ltd.

SEBI Registered Investment Adviser

Number of complaints received from all sources -

December 2025

Reasons for pendency : NA

Multipl Wealth Management Pvt. Ltd.

SEBI Registered Investment Adviser

Number of complaints received from all sources -

December 2025

Reasons for pendency : NA

Multipl Wealth Management Pvt. Ltd.

SEBI Registered Investment Adviser

Number of complaints received from all sources -

December 2025

Reasons for pendency : NA

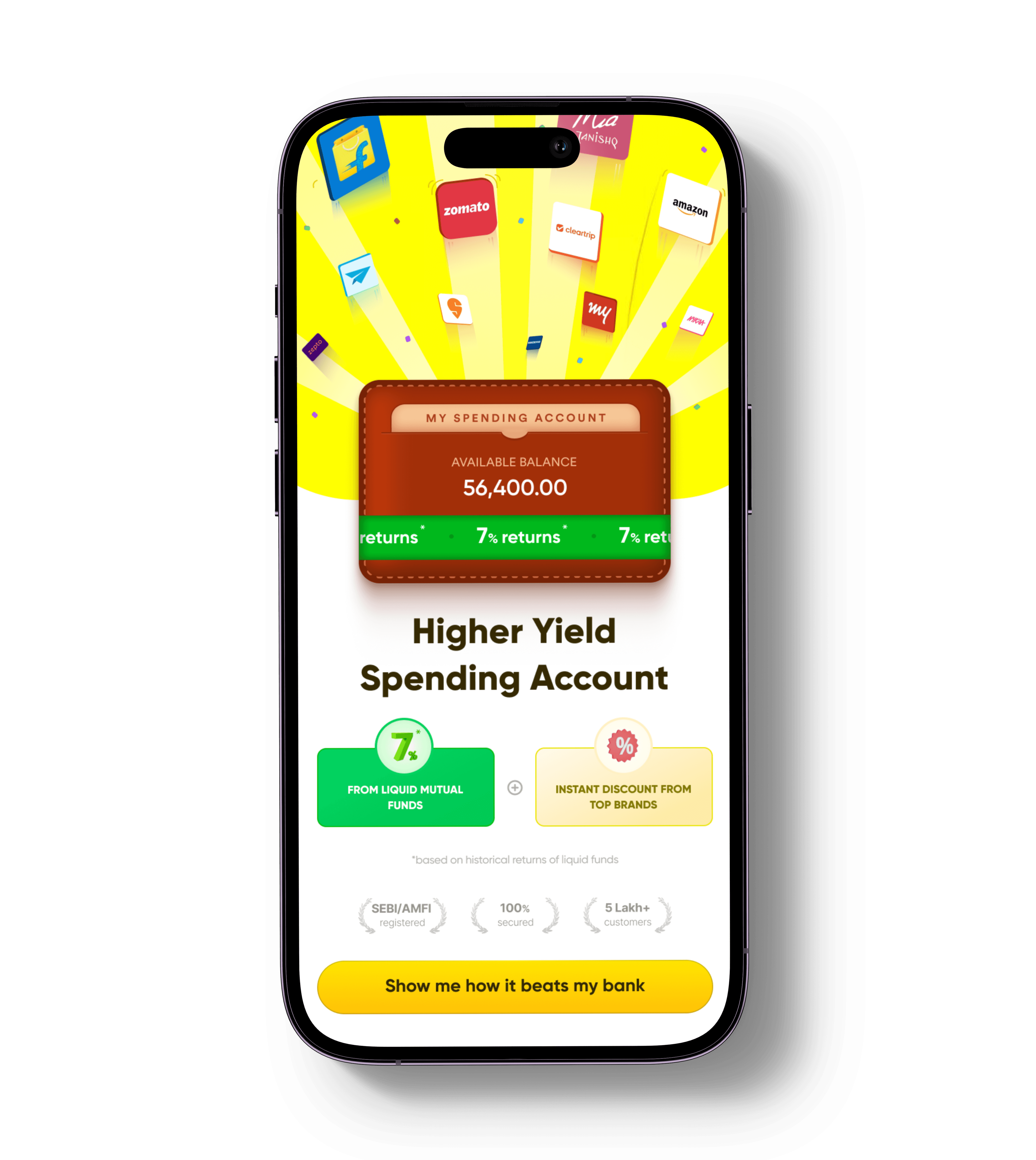

Make your spending money earn

Get 7%* returns on your money + brand discounts when you spend. SEBI-regulated. Withdraw anytime.

SEBI/AMFI

registered

5 lakh+

trusted users

*based on historical returns of liquid funds

₹1,500 saved with

Everyday commute

₹240 saved with

Late night food orders

₹2,200 saved with

Emergency travel plans

₹350 saved with

Monthly groceries

Why multipl is different?

Your Money Grows

Invest in SEBI regulated mutual funds at ~7%* returns

Your Money Grows

Invest in SEBI regulated mutual funds at ~7%* returns

Your Money Grows

Invest in SEBI regulated mutual funds at ~7%* returns

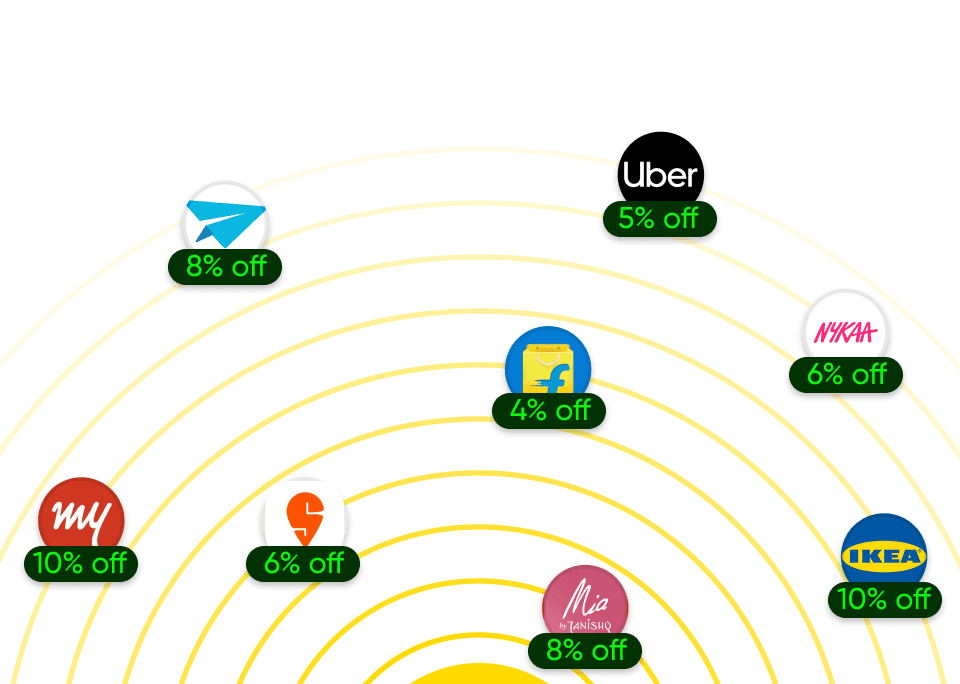

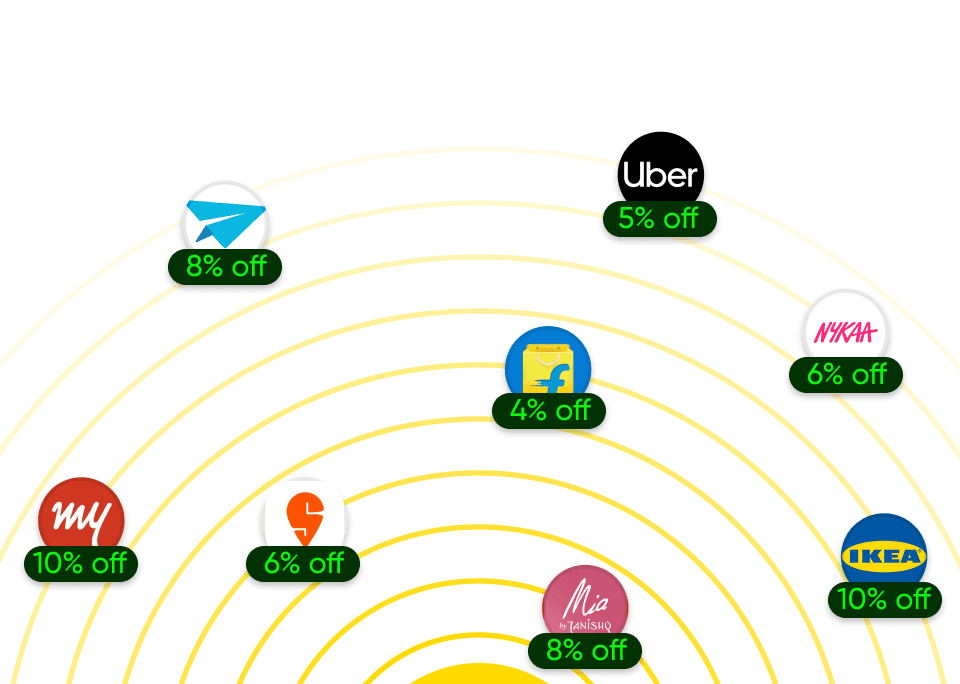

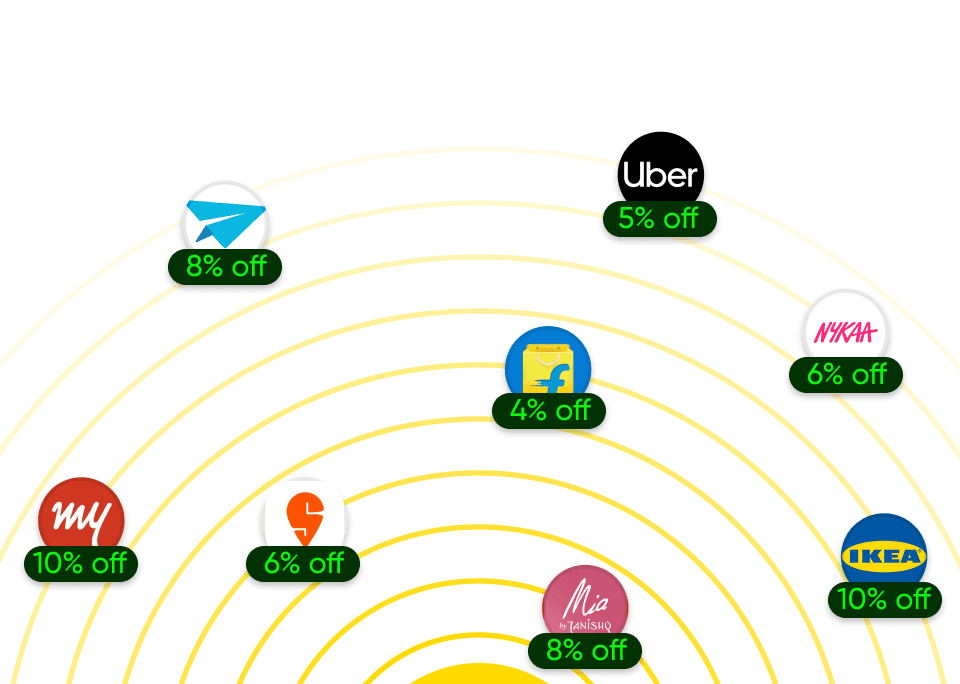

Get Brand Discounts

Choose from our 100+ partner brands and get discounts upto 20%

Get Brand Discounts

Choose from our 100+ partner brands and get discounts upto 20%

Get Brand Discounts

Choose from our 100+ partner brands and get discounts upto 20%

Save better on every spend

Lower bills today, smarter planning for bigger spends tomorrow.

Save better on every spend

Lower bills today, smarter planning for bigger spends tomorrow.

Save better on every spend

Lower bills today, smarter planning for bigger spends tomorrow.

*based on historical returns of liquid funds

users trust us

users trust us

users trust us

funds managed

funds managed

funds managed

brand partnerships

brand partnerships

brand partnerships

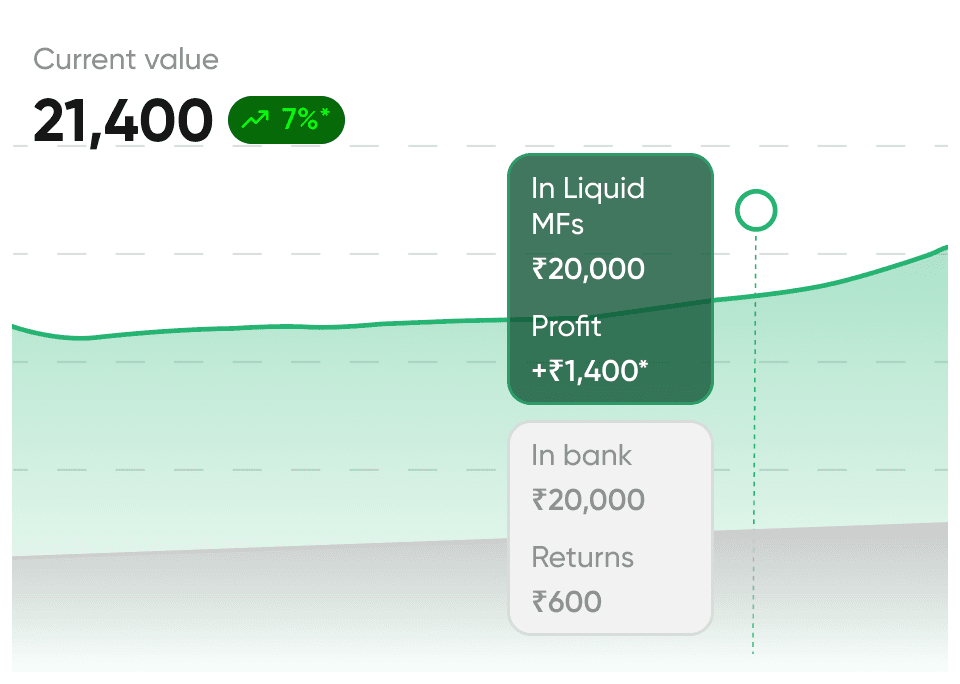

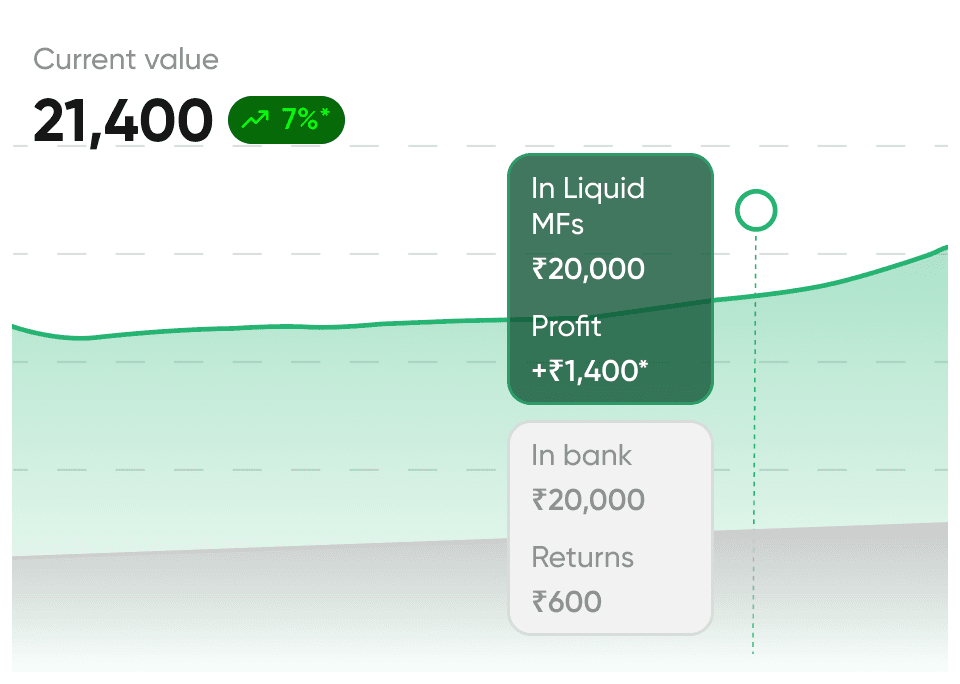

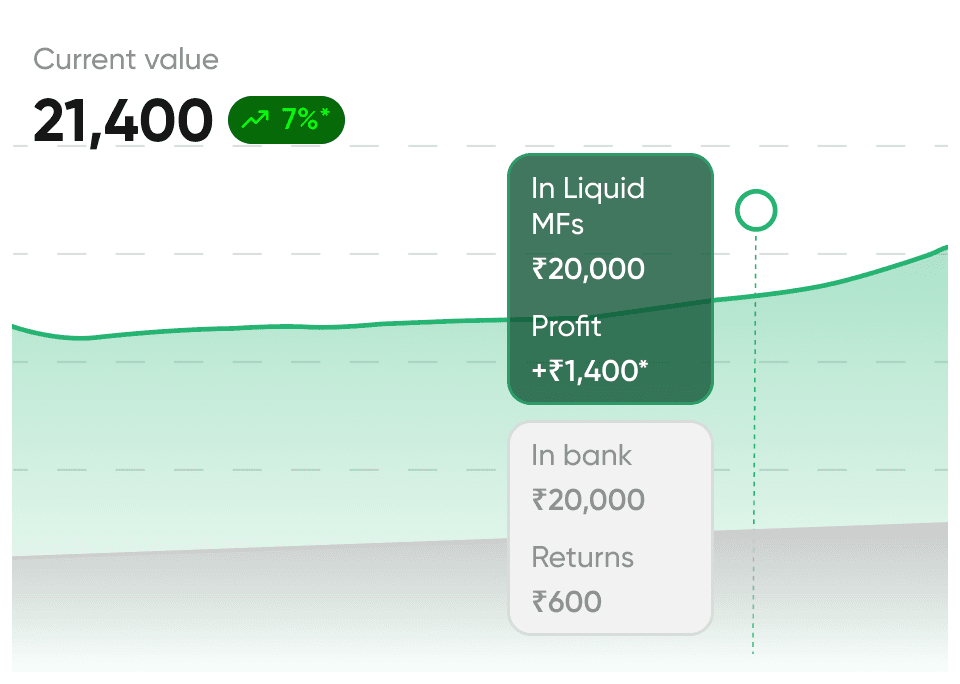

2.5% vs ~7%*

Where Your Spending Money Lives Matters

The money you keep aside for Swiggy, flights, EMIs, shopping usually sits in a low-yield bank account earning 2–3.5% per year. In Multipl, the same money can earn 7%* in liquid mutual funds until the day you actually spend it.

Idle without growth

No brand discounts

Loses to inflation

No expert guidance for growth

2.5%

from Savings Bank Account

vs

from Liquid Mutual Funds

7%*

More than 2x return vs banks

+

100+ brand discounts when you spend with spending account

Beats inflation with profit

Expert picked mutual funds from registered advisors

from Liquid Mutual Funds

7%

2.5%

from Savings Bank Account

*based on historical returns of liquid funds

Make your spending money earn.

Earn while your money waits to be spent.

A Higher-Yield Spending Account that gives you up to ~7%* returns plus brand discounts on every spend.

SEBI registered

investment advisors

5 lakh+

trusted users

*based on historical market returns of liquid funds

₹1,500 saved with

Everyday commute

₹240 saved with

Late night food orders

Make your spending money earn.

Earn while your money waits to be spent.

A Higher-Yield Spending Account that gives you up to ~7%* returns plus brand discounts on every spend.

SEBI registered

investment advisors

5 lakh+

trusted users

*based on historical market returns of liquid funds

₹1,500 saved with

Everyday commute

₹240 saved with

Late night food orders

How Your Higher-Yield Spending Account Works

Turn your spending goals into growth plans. Here’s how we help you make every rupee work smarter.

How Your Higher-Yield Spending Account Works

Turn your spending goals into growth plans. Here’s how we help you make every rupee work smarter.

How Your Higher-Yield Spending Account Works

Turn your spending goals into growth plans.Here’s how we help you make every rupee work smarter.

01

Move your spending money

Decide how much you usually spend in a month and move that from your bank to Multipl.

01

Move your spending money

Decide how much you usually spend in a month and move that from your bank to Multipl.

01

Move your spending money

Decide how much you usually spend in a month and move that from your bank to Multipl.

02

We invest in liquid mutual funds

Your balance is deployed into expert-selected, low-risk liquid mutual funds instead of lying idle in a bank.

02

We invest in liquid mutual funds

Your balance is deployed into expert-selected, low-risk liquid mutual funds instead of lying idle in a bank.

02

We invest in liquid mutual funds

Your balance is deployed into expert-selected, low-risk liquid mutual funds instead of lying idle in a bank.

03

Spend as usual

Shop with partner brands and get discounts from 2%-20%. Your money is always spend-ready.

03

Spend as usual

Shop with partner brands and get discounts from 2%-20%. Your money is always spend-ready.

03

Spend as usual

Shop with partner brands and get discounts from 2%-20%. Your money is always spend-ready.

04

Earn extra discounts on top

On 70+ partners, you get 2–10% brand discounts on spends you make anyway.

04

Earn extra discounts on top

On 70+ partners, you get 2–10% brand discounts on spends you make anyway.

04

Earn extra discounts on top

On 70+ partners, you get 2–10% brand discounts on spends you make anyway.

Powered By Liquid Mutual Funds – Not Just A Wallet

Powered By Liquid Mutual Funds – Not Just A Wallet

Your Spending Account uses liquid mutual funds under the hood – a low-risk category designed for short-term money.

Your Spending Account uses liquid mutual funds under the hood – a low-risk category designed for short-term money.

Message from our Co-Founder

Paddy Raghavan

Co-founder, CEO

01.

What are Liquid Mutual Funds?

Your spending account uses liquid mutual funds under the hood - a low-risk category designed for short term money.

Liquid mutual funds invest in short-term money market instruments with no lock-in.

02.

Why better than bank savings / many FDs?

03.

Can I withdraw instantly?

04.

What about taxes?

No investment is zero-risk. Liquid mutual funds are designed to park short-term money with minimal volatility and high liquidity. Our SEBI-registered advisory team carefully curates a small list of high-quality liquid funds suitable for a Spending Account.

01.

What are Liquid Mutual Funds?

Your spending account uses liquid mutual funds under the hood - a low-risk category designed for short term money.

Liquid mutual funds invest in short-term money market instruments with no lock-in.

02.

Why better than bank savings / many FDs?

03.

Can I withdraw instantly?

04.

What about taxes?

No investment is zero-risk. Liquid mutual funds are designed to park short-term money with minimal volatility and high liquidity. Our SEBI-registered advisory team carefully curates a small list of high-quality liquid funds suitable for a Spending Account.

01.

What are Liquid Mutual Funds?

Your spending account uses liquid mutual funds under the hood - a low-risk category designed for short term money.

Liquid mutual funds invest in short-term money market instruments with no lock-in.

02.

Why better than bank savings / many FDs?

03.

Can I withdraw instantly?

04.

What about taxes?

No investment is zero-risk. Liquid mutual funds are designed to park short-term money with minimal volatility and high liquidity. Our SEBI-registered advisory team carefully curates a small list of high-quality liquid funds suitable for a Spending Account.

Plan For All Your Spends

Turn your dreams into plans, from pizzas to iPhones to honeymoons, your spending account helps you get there debt-free.

Plan For All Your Spends

Turn your dreams into plans, from pizzas to iPhones to honeymoons, your spending account helps you get there debt-free.

Plan For All Your Spends

Turn your spending goals into growth plans.Here’s how we help you make every rupee work smarter.

Travel

Late night food

Late night food

Next Gadget

Education

Jewellery

Security money

Security money

Shopping

Fashion

Hobbies

Home Upgrade

Home Upgrade

Health Care

Dream car

Travel

Late night food

Next Gadget

Education

Jewellery

Security money

Shopping

Fashion

Hobbies

Home Upgrade

Health Care

Dream car

One app - 3 powerful ways to help you make the most of your money.

One app - 3 powerful ways to help you make the most of your money.

Spending Account

Save for a specific purchase by a set date, like an iPhone, trip, or wedding. Stay on track with a deadline and get brand gift cards on time.

Save for a specific purchase by a set date, like an iPhone, trip, or wedding. Stay on track with a deadline and get brand gift cards on time.

Spending Account

Save for a specific purchase by a set date, like an iPhone, trip, or wedding. Stay on track with a deadline and get brand gift cards on time.

Planned Spends

No goal planned? Just grow your money for future plans, like shopping, festivals, or gifts, and use it anytime across multiple brand partners.

No goal planned? Just grow your money for future plans, like shopping, festivals, or gifts, and use it anytime across multiple brand partners.

Planned Spends

No goal planned? Just grow your money for future plans, like shopping, festivals, or gifts, and use it anytime across multiple brand partners.

Wealth Account

Move surplus into long-term mutual fund portfolios curated by our SEBI-registered advisory team.

Move surplus into long-term mutual fund portfolios curated by our SEBI-registered advisory team.

Wealth Account

Move surplus into long-term mutual fund portfolios curated by our SEBI-registered advisory team.

Plan or No Plan. Save for anything, Anytime.

One app. Two powerful ways to plan your spends

Plan or No Plan. Save for anything, Anytime.

One app. Two powerful ways to plan your spends

Where do I begin?

Pick from our perfectly planned methods of using your money smartly.

FEATURES

FEATURES

Returns

Returns

Time Horizon

Time Horizon

Usecases

Usecases

Higher Yield Spending account

Higher Yield Spending account

7%* investment returns + ~10% brand discounts

7%* investment returns + ~10% brand discounts

Instant

Instant

Swiggy/Zepto deliveries, Monthly uber rides, Unplanned trips etc.

Swiggy/Zepto deliveries, Monthly uber rides, Unplanned trips etc.

Planned Spending Account

Planned Spending Account

7%-15%* investment returns + ~10% brand discounts

7%-15%* investment returns + ~10% brand discounts

3-12 months

3-12 months

Planned travel, next iPhone/macbook, Jewellery etc.

Planned travel, next iPhone/macbook, Jewellery etc.

Wealth Account

Wealth Account

15%-20%* investment return

15%-20%* investment return

>3 years

>3 years

Wealth creation, retirement fund, emergency fund, dream house etc.

Wealth creation, retirement fund, emergency fund, dream house etc.

*historical returns of mutual funds in the debt, hybrid, equity and alternative categories as applicable

₹240 saved on grocery delivery

₹240 saved on grocery delivery

Redeemed with Zepto

₹8,000 saved on new iPhone

₹8,000 saved on new iPhone

Redeemed with Flipkart

₹240 saved on grocery delivery

Redeemed with Zepto

₹8,000 saved on new iPhone

Redeemed with Flipkart

Smart, Safe & Built for you

Built with security, transparency, and expert guidance — so you can grow your money with complete peace of mind.

Smart, Safe & Built for you

Built with security, transparency, and expert guidance — so you can grow your money with complete peace of mind.

Smart, Safe & Built for you

Turn your spending goals into growth plans.Here’s how we help you make every rupee work smarter.

SEBI/AMFI registered investment advisors

Your investments are guided by SEBI-registered experts, CAs, CFAs and IIM MBAs, so you're backed by the highest standards of trust and compliance from AMFI and BSE.

Unbiased allocation

We don’t promote any specific fund houses. Every mutual fund is chosen solely based on what’s best for your goal.

Withdraw Anytime

Your funds don't stay with us. Withdraw anytime. Your money stays flexible, just like your goals.

Secured Transactions

Your money moves through bank-grade encryption and secured Razorpay payment gateways

SEBI/AMFI registered investment advisors

Your investments are guided by SEBI-registered experts, CAs, CFAs and IIM MBAs, so you're backed by the highest standards of trust and compliance from AMFI and BSE.

Unbiased allocation

We don’t promote any specific fund houses. Every mutual fund is chosen solely based on what’s best for your goal.

Withdraw Anytime

Your funds don't stay with us. Withdraw anytime. Your money stays flexible, just like your goals.

Secured Transactions

Your money moves through bank-grade encryption and secured Razorpay payment gateways

Brand discounts and Mutual funds come together for you

Save even more when you invest with Multipl. Unlock offers from top brands when you redeem your goal.

Brand discounts and Mutual funds come together for you

Save even more when you invest with Multipl. Unlock offers from top brands when you redeem your goal.

Brand discounts and Mutual funds come together for you

Save even more when you invest with Multipl. Unlock offers from top brands when you redeem your goal.

Brand discounts and Mutual funds come together for you

Save even more when you invest with Multipl. Unlock offers from top brands when you redeem your goal.

Brand discounts and Mutual funds come together for you

Save even more when you invest with Multipl. Unlock offers from top brands when you redeem your goal.

Real People. Real Goals. Real Savings.

Hear how Multipl is helping users save smarter, spend better, and reach their goals — without EMIs or regrets.

This app is very good for investing daily or monthly or one time investment when withdrawal the amount is added some brand benefits also.

Rathna Shree

Love the seamless and well thought out UI, sign up was absolutely glitch-free, reminds me of the premier investment apps in the western world like Stripe and Robinhood

Saran Vashisht

This savings app is a game-changer! The installment feature makes saving manageable, and the added bonus of brand vouchers is fantastic. Redeeming them boosts my savings even further. Highly recommend for anyone looking to grow their money while enjoying extra perks!

Sesha Pramod

One of the finest and best app regarding every little to big goal, here you can create many goals, like for shopping, travel, family planning, retirement plan, and many more, and the best part is that here brands also support you get extra money , brands contribute some extra percentage, with your investment amount

Garvit Saraf

This app is very good for investing daily or monthly or one time investment when withdrawal the amount is added some brand benefits also.

Rathna Shree

Love the seamless and well thought out UI, sign up was absolutely glitch-free, reminds me of the premier investment apps in the western world like Stripe and Robinhood

Saran Vashisht

This savings app is a game-changer! The installment feature makes saving manageable, and the added bonus of brand vouchers is fantastic. Redeeming them boosts my savings even further. Highly recommend for anyone looking to grow their money while enjoying extra perks!

Sesha Pramod

One of the finest and best app regarding every little to big goal, here you can create many goals, like for shopping, travel, family planning, retirement plan, and many more, and the best part is that here brands also support you get extra money , brands contribute some extra percentage, with your investment amount

Garvit Saraf

You can trust them, they are genuine you get the receipt of the mutual fund from the respective AMC once your order is processed successfully. Their customer executive team is really helpful. Just tell them the issue they will sort it and provide you with the best possible resolution.

Sharath A

It's a more organised and systematic investment app. Since it offers with a low amount it sound interesting.

Dr Murali Basa

Having good customer support and having good experience with this app. It is worth as well.

Srikar Katakam

Loved the idea behind this app. Set your goals and save money as per your own flexibility, get returns on that based on your risk appetite and also the fact that great offers are there for your goals like buying jewellery, home appliances, travel trips.. All in all I found this app great because it lets you save and earn both at the same time. Regarding the customer support experience, team was easy to reach, and quick to guide and respond to my issue! I highly recommend try this app once!!

Diksha Sharma

You can trust them, they are genuine you get the receipt of the mutual fund from the respective AMC once your order is processed successfully. Their customer executive team is really helpful. Just tell them the issue they will sort it and provide you with the best possible resolution.

Sharath A

It's a more organised and systematic investment app. Since it offers with a low amount it sound interesting.

Dr Murali Basa

Having good customer support and having good experience with this app. It is worth as well.

Srikar Katakam

Loved the idea behind this app. Set your goals and save money as per your own flexibility, get returns on that based on your risk appetite and also the fact that great offers are there for your goals like buying jewellery, home appliances, travel trips.. All in all I found this app great because it lets you save and earn both at the same time. Regarding the customer support experience, team was easy to reach, and quick to guide and respond to my issue! I highly recommend try this app once!!

Diksha Sharma

You can trust them, they are genuine you get the receipt of the mutual fund from the respective AMC once your order is processed successfully. Their customer executive team is really helpful. Just tell them the issue they will sort it and provide you with the best possible resolution.

Sharath A

It's a more organised and systematic investment app. Since it offers with a low amount it sound interesting.

Dr Murali Basa

Having good customer support and having good experience with this app. It is worth as well.

Srikar Katakam

Loved the idea behind this app. Set your goals and save money as per your own flexibility, get returns on that based on your risk appetite and also the fact that great offers are there for your goals like buying jewellery, home appliances, travel trips.. All in all I found this app great because it lets you save and earn both at the same time. Regarding the customer support experience, team was easy to reach, and quick to guide and respond to my issue! I highly recommend try this app once!!

Diksha Sharma

I started planning my 2 year old's school fee on Multipl. When she will start going to school in the next 2 years, I'm confident on Multipl on the returns part. When it comes to the app, you guys have done an amazing job with the UI. The app is so easy to use. I really liked the Purchase Protection feature.

Purnachandran

It's a very user friendly app with rich UI and simple to use. We can create the goals in no time and can easily track them. Best part is the flexibility to create our own goals with a wide range of options and best brands to choose. Rewards are awesome. Overall it provides a easy way to start the short-term and long-term investment in few minutes...

Raghunanthan Gopal

This app has excellent design. The layout is comfortable and navigation is smooth. I could create my profile and my first investment goal easily. The brand specific investment options have good variety and I'll be opting for the travel, mattress and electric bike one. Overall its an easy to use app and I'm always excited to see what new brand specific options they'll get this time. I also enjoy their posts on Instagram, Facebook and LinkedIn on a regular basis.

Abhishek Sainani

I learned about multipl through Facebook while searching for a better investment/saving option. The app is very user-friendly! One can easily set up an account and make goals that suit them the best. the amount is autoinvested every month in personalised, curated mutual funds considering my risk profile. I have created 5 goals, from travel to buying gold and I look forward to making more. The app is unique, unlike other apps, as I can earn market returns & get various vouuchers from top brands

Madhavi Kulkarni

I started planning my 2 year old's school fee on Multipl. When she will start going to school in the next 2 years, I'm confident on Multipl on the returns part. When it comes to the app, you guys have done an amazing job with the UI. The app is so easy to use. I really liked the Purchase Protection feature.

Purnachandran

It's a very user friendly app with rich UI and simple to use. We can create the goals in no time and can easily track them. Best part is the flexibility to create our own goals with a wide range of options and best brands to choose. Rewards are awesome. Overall it provides a easy way to start the short-term and long-term investment in few minutes...

Raghunanthan Gopal

This app has excellent design. The layout is comfortable and navigation is smooth. I could create my profile and my first investment goal easily. The brand specific investment options have good variety and I'll be opting for the travel, mattress and electric bike one. Overall its an easy to use app and I'm always excited to see what new brand specific options they'll get this time. I also enjoy their posts on Instagram, Facebook and LinkedIn on a regular basis.

Abhishek Sainani

I learned about multipl through Facebook while searching for a better investment/saving option. The app is very user-friendly! One can easily set up an account and make goals that suit them the best. the amount is autoinvested every month in personalised, curated mutual funds considering my risk profile. I have created 5 goals, from travel to buying gold and I look forward to making more. The app is unique, unlike other apps, as I can earn market returns & get various vouuchers from top brands

Madhavi Kulkarni

I started planning my 2 year old's school fee on Multipl. When she will start going to school in the next 2 years, I'm confident on Multipl on the returns part. When it comes to the app, you guys have done an amazing job with the UI. The app is so easy to use. I really liked the Purchase Protection feature.

Purnachandran

It's a very user friendly app with rich UI and simple to use. We can create the goals in no time and can easily track them. Best part is the flexibility to create our own goals with a wide range of options and best brands to choose. Rewards are awesome. Overall it provides a easy way to start the short-term and long-term investment in few minutes...

Raghunanthan Gopal

This app has excellent design. The layout is comfortable and navigation is smooth. I could create my profile and my first investment goal easily. The brand specific investment options have good variety and I'll be opting for the travel, mattress and electric bike one. Overall its an easy to use app and I'm always excited to see what new brand specific options they'll get this time. I also enjoy their posts on Instagram, Facebook and LinkedIn on a regular basis.

Abhishek Sainani

I learned about multipl through Facebook while searching for a better investment/saving option. The app is very user-friendly! One can easily set up an account and make goals that suit them the best. the amount is autoinvested every month in personalised, curated mutual funds considering my risk profile. I have created 5 goals, from travel to buying gold and I look forward to making more. The app is unique, unlike other apps, as I can earn market returns & get various vouuchers from top brands

Madhavi Kulkarni

Real People. Real Goals.Real Savings.

Hear how Multipl is helping users save smarter, spend better, and reach their goals — without EMIs or regrets.

Real People. Real Goals.Real Savings.

Hear how Multipl is helping users save smarter, spend better, and reach their goals — without EMIs or regrets.

Real People. Real Goals. Real Savings.

Hear is how Multipl is helping users save smarter, spend better, and reach their goals, without EMIs or regrets.

Real People. Real Goals. Real Savings.

Hear is how Multipl is helping users save smarter, spend better, and reach their goals, without EMIs or regrets.

Any Questions?

Why should I move my spending money out of a bank when banks feel safer?

Why should I move my spending money out of a bank when banks feel safer?

Why should I move my spending money out of a bank when banks feel safer?

Do I need to move a lot of money into the Spending Account to use it?

Do I need to move a lot of money into the Spending Account to use it?

Do I need to move a lot of money into the Spending Account to use it?

Is this a savings product or a spending product? I’m finding it hard to see the value.

Is this a savings product or a spending product? I’m finding it hard to see the value.

Is this a savings product or a spending product? I’m finding it hard to see the value.

Is it safe to use mutual funds for spending money? What about delays or tax complexity?

Is it safe to use mutual funds for spending money? What about delays or tax complexity?

Is it safe to use mutual funds for spending money? What about delays or tax complexity?

Isn’t mixing spending and investing confusing? Spending and investing feel like opposite mindsets.

Isn’t mixing spending and investing confusing? Spending and investing feel like opposite mindsets.

Isn’t mixing spending and investing confusing? Spending and investing feel like opposite mindsets.

How do I earn ~7%* returns if I’m spending money continuously? Can you show an example?

How do I earn ~7%* returns if I’m spending money continuously? Can you show an example?

How do I earn ~7%* returns if I’m spending money continuously? Can you show an example?

Is my money safe? Will there be market fluctuations in Liquid Mutual Funds?

Is my money safe? Will there be market fluctuations in Liquid Mutual Funds?

Is my money safe? Will there be market fluctuations in Liquid Mutual Funds?

Any questions?

Any questions?

Savings calling. Answer?

Start planning your next big purchase with Multipl — grow your money, earn rewards, and skip the EMIs.

Savings calling. Answer?

Start planning your next big purchase with Multipl — grow your money, earn rewards, and skip the EMIs.

Savings calling. Answer?

Turn your spending goals into growth plans.Here’s how we help you make every rupee work smarter.

multipl

Multipl Wealth Management Private Limited

SEBI Registered Investment Advisers

SEBI Reg. No. INA200014681

Type of Registration: Non-Individual

Validity: Perpetual

Registration granted by SEBI,

enlistment with BSE and certification from NISM

in no way guarantee performance of the intermediary

or provide any assurance of returns to investors.

AMFI Registered Distributor

AMFI Registration Number : ARN-319633

Validity period from: 22-JAN-2025 To 21-JAN-2028

Escalation Matrix

Level 1 - Compliance Officer

Level 2 - Principal Officer

SEBI-Bengaluru office address &

contact

2F, Jeevan Mangal Bldg.,

No.4 Residency Road,

Bengaluru - 560025, Karnataka;

+91-80-22222262/64/83;

Number of complaints received from all sources -

December 2025

Reasons for pendency : NA

multipl

Multipl Wealth Management Private Limited

SEBI Registered Investment Advisers

SEBI Reg. No. INA200014681

Type of Registration: Non-Individual

Validity: Perpetual

Registration granted by SEBI,

enlistment with BSE and certification from NISM

in no way guarantee performance of the intermediary

or provide any assurance of returns to investors.

AMFI Registered Distributor

AMFI Registration Number : ARN-319633

Validity period from: 22-JAN-2025 To 21-JAN-2028

Escalation Matrix

Number of complaints received from all sources -

December 2025

Reasons for pendency : NA